10 Simple Techniques For Forex Spread Betting

Wiki Article

Not known Facts About Forex Spread Betting

Table of ContentsForex Spread Betting - The FactsThe 10-Second Trick For Forex Spread BettingThe 2-Minute Rule for Forex Spread BettingForex Spread Betting - Truths

This is just how much you can make or lose on a spread wager for every single point of activity in the cost of the market. It is likewise referred to as the risk size. This refers to the closure of a placement, as well as the end result establishes whether you have made a profit or a loss.

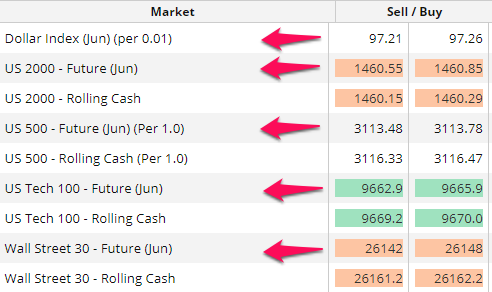

during bouts of extreme volatility, when rates move dramatically up or down. The spread is the difference between the 2 estimate on every spread bet: the deal rate for the same property. Often shortened to DFB, this term describes a setting that continues to be open till you make a decision to shut it.

Facts About Forex Spread Betting Revealed

If you think a property is going to increase in price, you can acquire a setting in that asset through a spread wager. By comparison, if you believe the cost is going to drop, you can sell the spread wager.

A margin call is made when the equity in your account the complete funding you have transferred plus or minus any type of revenues or losses drops below the minimum requirement. If this is the instance, there is a danger that the broker will automatically shut your positions, potentially leaving you with losses.

The over here spread is the distinction between a broker's sell and also purchase (bid and deal) costs (forex spread betting). If discover this info here the FTSE 100 index is at 7100, a spread-betting firm might estimate a spread of 70997101.

Forex Spread Betting for Beginners

In general, the smaller the spread the far better, as you require the rate to relocate much less in your direction before you begin earning a profit. There are a variety of spread-betting techniques that can be deployed. Visit for more information on techniques and also a large range of added educational product.Arbitrage entails the synchronised purchase as well as sale of the very same asset in different markets in order to profit from small differences in the rate. Spread betters do this when short term activities by customers and also vendors at a certain broker differ from those at an additional, resulting in different rates (forex spread betting). While the quotes provided on broker internet sites reflect the hidden rate movements in the instruments they are based on, they are not constantly similar.

This approach includes trading based upon news and also market assumptions, both previously as well as following news launches. You will need to act quickly and also be able to make a quick reasoning on just how to trade a brand-new statement or item of data. You will additionally have to have the ability to evaluate whether the news is currently factored right into the stock rate and also whether the information matches investor assumptions.

The negative aspect is that you need considerable expertise in how markets operate as well as just how to analyze information and also news - forex spread betting. According to the broker CMC Markets, this style of trading needs less time dedication than various other trading techniques since content there is just a demand to study charts at their opening as well as closing times.

The Definitive Guide for Forex Spread Betting

The method concentrates on studying the existing day's price contrasted with the previous day's cost activities, and making use of that as an overview to just how the marketplace is likely to relocate - forex spread betting. Investors can use various tools to restrict their overnight threat, such as establishing a take-profit order or a stop-loss limitation.They depend on indicators to establish when a fad is taking hold as well as after that trade on the basis that that pattern will certainly proceed. Technical-analysis investors begin by seeking to understand where the cost is heading according to the basics of supply as well as need.

Additionally, in an uptrend, a line on the chart attaching previous highs will certainly work as resistance when over the present level, while a line attaching previous lows will certainly act as support with the reverse real in a falling market. Swing trading is a design of trading that concentrates on temporary trends in a monetary instrument over a duration of a few days to several weeks.

If this is done continually in time, reasonably little gains can intensify into exceptional annual returns. Swing investors must focus on the most proactively traded stocks that reveal a propensity to turn within broad, distinct limits. It's a great concept to focus on a choose group of financial tools, and check them daily, to ensure that you understand the price activity they normally display.

Report this wiki page